Robust green bond market to expand still further

With a robust first quarter of 2021, the issuance of green bonds continues apace. The European Union and its “NextGenerationEU” sustainability bond programme along with the US administration's wish to invest up to $1tn in sustainable projects in the coming eight years is set to keep the market expanding

Issuance back on track for another yearly record

All currencies included, more than €81bn of green bonds equal to or larger than €100m were issued on the markets in the first quarter of 2021. These first three months represent a bit less than half the total green bond issuance in 2020. Of course, we believe that 2020 issuance, despite surpassing 2019, lost some steam because of the attention dedicated to the Covid-19 pandemic's negative impact and the need to issue social and sustainable bonds issued to mitigate the effect of the crisis.

The first quarter of 2021 proves that the milder growth in 2020 was just a “technical’ slow down and that the climate and the energy transition issues remain top priorities for governments and a number of companies.

Total Green bonds issuance

2013 - Q1 2021. EUR billion equivalent

The most active issuers

Financial institutions and industrials were the most active issuers on the green bond markets with respectively €23.5bn and €20bn, each representing around 25% of total green issuance in the first quarter of 2021. For the first time, a non-financial sector is now top of the issuance leaderboard and that's industrials; the number-one position is usually taken by utilities.

Industrials' players, coming from diverse sub-sectors such as Ardagh Metal Packaging, Novelis, and Faurecia, came to the bond market with green inaugural bonds. Automotive players such as Daimler and Hyundai Motor Company returned to the green bond market to continue their expansion into the eco-friendly vehicles projects.

| 37% |

Green bonds issuedIn USD in the first quarter of 2021 |

USD green bond issuance would spike on US administration's new sustainability ambitions

In line with what we have seen in the previous quarters and indeed years, the euro remains the main currency used to print green bond. Bonds issued in USD represented 37% of total issuance in Q1 2021. We believe that issuance in USD, especially from US agencies and corporates could spike up in the coming months and years on the back of the new US administration’s ambition to put the country in line with some sustainable targets.

| $1tn |

Spend on sustainable projects by the Biden administration |

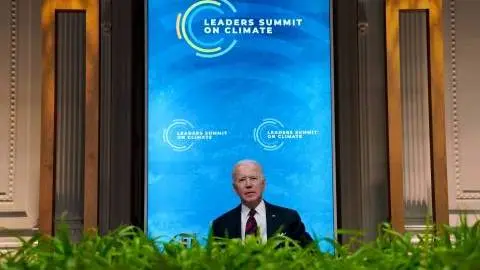

What's happening in the US

Joe Biden's plan intends to spend a trillion dollars over an 8-year period on sustainability projects, and the wording of the documentation is littered with public-private partnership ambitions. The expectation would be for the private sector to embrace initiatives that list off to include renewable energy, electric vehicles and a wider decarbonisation of the economy and green ambitions over time. We've written in detail about that here, but here are the main points:

- A key positive is that policy is coming from the top. It may need more stick (carbon taxes) than carrot (grants and partnerships) for it to prove really effective at long term de-carbonization, but there is a clear swing of the policy pendulum relative to the previous administration, one that is positioning itself to show more embrace of the need for action on climate change.

- A positive underpinning factor is that corporate America had been embracing many of these ideals through their funding programs; more of a bottom-up approach to sustainable thinking. The Biden plan in that respect cheerleads existing ambition for corporate America to do more. And there is room to do more. While about a third of overall sustainable finance issues is denominated in US dollars, issuance from US-domiciled entities is running at under a fifth (of global issuance).

- The rise in USD dollar-denominated issuance as a proportion of the total shows there is clearly demand for USD denominated bonds with a sustainable finance twist (green, social and sustainability bonds). US sustainable finance issuance in Q1 2021 is impressive, at US$55bn. That, in just one quarter, is half what was seen over 2020 as a whole. However, this is just keeping pace with what is happening elsewhere, as the proportion of US borrowing in sustainable finance remains at just under 20% in bonds (and at 15% when loans are included).

So, it's good that the pace is being kept up, but the rise in USD issuance shows there is a solid market out there for more.

| 59% |

Green bonds issued in EURQ1 2021 |

The EUR remains the green bonds' leading currency and the EU programme will keep issuance growing

With 59% of the total green bond issuance in the first three months of the year, the EUR currency continued to support European governments, agencies and companies’ leadership as far as sustainability investments are concerned. While governments and agencies’ green bond issuance in the first quarter of 2021 was in line with what we saw in 2020, we think that their participation in the green bond instrument could see a new acceleration when the Covid-19 pandemic is behind us.

On 14 April 2021, The European Union released its objectives in terms of sustainability bond issuance. Between mid-2021 and 2026, the total “NextGenerationEU” bond issuance will amount to €800bn, including 30% (€250bn) as green bonds.

In 2021, up to €65bn will be brought to the market from July onwards after the EU has finalised its European green bond standards. The aim of the programme is to support the European green transition as well as boost the size of the green bonds’ market and enable investors to diversify further their portfolio of green investments.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 April 2021

What a wonderful world This bundle contains 6 Articles